Creditors with inexhaustible sources, but Entire World in Debt

Publications regarding debt issues, either globally or country-related, prominently illustrate the scales of debts and their respective economic impacts. Global Creditors identifications and their seemingly inexhaustible sources as if “only the sky is the limit”, remain largely unknown to most of us. Countries in debt crisis often in sheer desperation prefer calling upon the International Monetary Fund (IMF) or The World Bank for conditional relief action. Both globally operating institutions have been run by a European for the IMF and the World Bank by a US national. Though “prima facia” IMF and WB are commonly accepted prime creditors, a more analytical view does not support this stand. Central Banks only are legalized money creators. Though often quoted but only partial true, IMF and WB are no Creditors. In fact, resources for IMF loans to its members on non-concessional terms are provided by member countries, primarily through their payment of quotas. Additionally, Multilateral and Bilateral borrowing serve as a second and third line of defense, respectively, where Central Banks play a leading role. Central Banks generate electronic money with simple mouse clicks, as Fed Chair Jerome Powell confirmed to a US Networks Reporter some time ago.

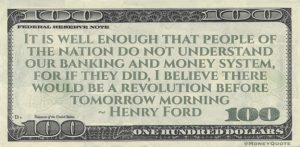

Subsequent electronic transfers to source US Commercial Banks is ongoing practice nowadays. The common man’s perception “Money Rules the World” requires a closer look to an inter-connected question as to “Who rules the Money”.

In the United States of America the entitlement to print money is solely authorized to the United States Federal Reserve Bank. It was created on December 23, 1913, with the enactment of the Federal Reserve Act. Concluding – Who owns the Central Banks, owns the money. And who owns the US Federal Reserve Bank? Surprising to many, the US FED is owned by a consortium of privately-owned banks namely the Rothschild Family, Goldman Sachs Bank, Rockefellers, Kuhn & Loeb, Warburg Family, Lazard Family to name the principal shareholders. The US Government executes certain control mechanisms but does not own shares of its FED. “Business Insider Australia” referred that Central Banks all over the Globe are recklessly printing Money. A recent publication in the German FOCUS Magazine and the WELT refers to an explosion of Nations Borrowing indicating 300 Trillion US Dollars (300.000.000.000.000) as the actual global debt figure in 2021. For 2022 another 28 Trillion US Dollars is required as additional new borrowings. This could be the recipe for a global economic nightmare, it says. The Global Debt 2020 of 28 Trillion USD Total exceeds the entire US GDP in 2021 which accumulates to 20.89 trillion U.S. dollars. The new global borrowing alone for 2022 exceeds China’s, Russia’s and Germany’s total GDP in summary for 2021

And jet another critical issue remains as U.S. Representative Ron Paul in his letter to the US Treasury wrote: I am writing regarding Article 4, Section 2b of the International Monetary Fund (IMF)’s Articles of Agreement. As you may be aware, this language prohibits countries who are members of the IMF from linking their currency to gold. Thus, the IMF is forbidding countries suffering from an erratic monetary policy from adopting the most effective means of stabilizing their currency.

In the late 1970’s President Richard Nixon dissolved the Gold backed US Dollar on grounds of raising more money for the Vietnam war enabling the US FED from that day to generate money without any Gold Standards in place.

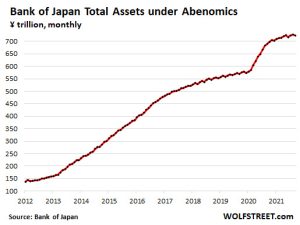

Even many advocators of the MMT ( Modern Money Theory) are in support of the present ongoing practice of excessive money creating. The global quantity of money creation is hitting record highs by the day with everyday new record highs in the loom. One of the biggest Money Printers, the Bank of Japan quintupled money printing within a period of 8 years.

Leading economists see a practicable solution in an the after crisis scenario with the re-implementation of gold standards combined with currency reforms. dd