Surging Russian Inbound Tourism in Sri Lanka:

“Strike While the Iron is Hot”

By

By

Prof DAC Suranga Silva & Laksiri Karunananda

Since reopening its borders in January 2021, Sri Lanka has rapidly emerged as a preferred destination for Russian tourists. Russians consistently ranked as the second-largest source market for Sri Lanka from 2022 through the first half of 2025, trailing only India.

In 2023, Sri Lanka welcomed a record 197,498 Russian visitors—a 116% increase over 2022—making up 13% of all tourist arrivals. By early 2025, Russians continued to represent a significant share of inbound tourism in Sri Lanka, with over 63,000 arrivals in just the first two months of the year.

This growth has been propelled by the introduction of direct charter flights from remote Russian cities such as Novosibirsk, Krasnoyarsk, Sochi, and Kazan, operated by carriers like Azur Air and Red Wings. These connections have made Sri Lanka accessible to a broader segment of Russian travelers.

Russia’s Economic Resilience for Fueling Outbound Tourism

Despite facing unprecedented Western sanctions since 2022, Russia’s economy has demonstrated notable resilience. After a slight GDP contraction of 1.2–2.1% in 2022, it rebounded with 3.6–4.1% growth in 2023 and maintained strong performance in 2024. This recovery is supported mainly by Russian new trade partnerships, which also bolsters outbound tourism. Emerging trends in Russian outbound travels include longer stays, diversified destinations and a rise in digital nomadism.

This resilience is underpinned by:

- Trade Realignment: Deepened economic ties with China, India, Turkey, and BRICS nations.

- Export Revenues: High global energy prices in 2022–2023 boosted export income.

- Import Substitution: Promotion of domestic brands and continued access to Western goods via intermediaries.

- Financial Safeguards: Central bank interventions, including interest rate hikes and capital controls, stabilized the ruble, which appreciated over 40% in early 2025.

- Military-Driven Output: Increased defense spending supported GDP and job creation.

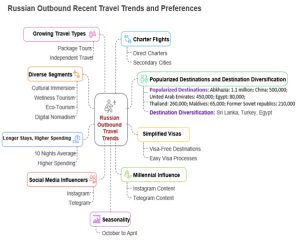

Russian outbound tourism spending reached nearly $38 billion in 2024, surpassing pre-pandemic levels. The ruble’s strength and resilient consumer demand have enabled Russians to maintain and even expand their international travel, despite global headwinds.

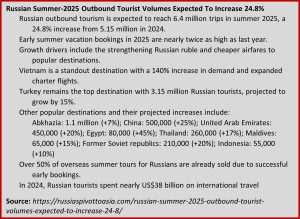

Russian Outbound Tourism: Key Trends and Indicators

Russian outbound tourism has rebounded sharply, with 2024 seeing about 29–30 million international trips—a 17–25% increase over 2023. The market is projected to grow from $46.2 billion in 2025 to $105.7 billion by 2035, with a CAGR of 8.6%.

Key Trends:

- Destination Diversification: Russians increasingly travel to friendly or visa-accessible destinations, including Sri Lanka, Turkey, Egypt, Thailand, Maldives, and Vietnam.

- Seasonality: Peak travel occurs from October to April

- Simplified Visas: Preference for destinations with easy visa processes

- Longer Stays, Higher Spending: Russians average 10 nights abroad and spend more per trip than many European counterparts.

- Social Media Influencers: Social media platforms like Instagram and Telegram heavily influence travel decisions, especially among millennials.

- Millennial Influence: Travel decisions are shaped by social media content, especially on Instagram and Telegram

- Growing Both Package and Independent Travels: Both package tours (favored by families and older travelers) and independent travel (popular with millennials and digital nomads) are growing

- Charter Flights: Direct charters from secondary Russian cities have democratized transport modes in Russia

- Diverse Segments with Growing Interests: Increasing interest in cultural immersion, wellness, participatory tourism, and eco-tourism with a rise of digital nomadism, combining travel with remote work and community collaboration.

- Global Tourism Influencer with High Spending: Russian outbound travel is growing rapidly, with trips projected to increase from 22 million in 2024 to 37 million by 2035

Russian Inbound Tourism in Sri Lanka: “Strike While the Iron is Hot”

To capitalize on this market, Sri Lanka should enhance its services, marketing efforts, and infrastructure while thoroughly understanding of Russian tourists’ attractions and preferences

- Beaches and Wellness: Russians favor Sri Lanka’s coastal resorts, with beach tourism, snorkeling, diving, and fishing as top activities. There is a growing interest in Ayurveda, yoga, and meditation.

- Long-Stay Visitors: Many retirees and remote workers stay 1–3 months, particularly in Mirissa, Hikkaduwa, and Arugam Bay and develop markets specialized offers for long-stay and winter Russian tourists.

- Cultural Adaptation: Businesses increasingly offer Russian-language menus, signage, and staff to cater to Russian guests.

- Connectivity: Seasonal and scheduled flights from Aeroflot, Azur Air, and Red Wings should connect Russia to both Colombo and Mattala airports.

- Expand Charter Flights: Restore and expand direct charters from more Russian cities; facilitate approvals for Russian carriers.

- Digital Nomad Hub: Invest in infrastructure and visa policies to attract remote workers.

- Russian-Friendly Services:Enhance Russian-language services and staff training.

- Luxury & Niche Tourism:Target affluent Russians with high-end resorts and exclusive experiences.

- Wellness Promotion:Leverage Sri Lanka’s Ayurveda and wellness offerings.

- Visa Facilitation:Maintain free visa policies and streamline extensions for Russians.

- Enable “Mir” Card Payments:Allow Russian tourists to use their domestic payment cards, boosting local spending.

- Competitive Pricing:Avoid hotel rate hikes that could deter charter operators.

- Marketing & Promotion:Go beyond Moscow—organize roadshows in major Russian cities and collaborate with influencers on social media.

- Infrastructure Upgrades:Improve highways, Wi-Fi, family facilities, nightlife, and attractions to suit Russian preferences.

- Monitor Trends:Continuously track Russian travel patterns and adapt strategies dynamically.

Key Challenges

- Charter Flight Suspensions: In summer 2025, Russian charter flights were paused due to lower demand and limited promotion, threatening Sri Lanka’s visitor targets.

- High Leakages: While Russian tourists contribute significantly to Sri Lanka’s tourism revenues, unauthorized business operations, profit repatriation, use of foreign currencies, and limited local sourcing cause substantial economic leakages, undermining the full potential benefits of this market to Sri Lanka’s economy.

- Revenue Shortfall: Despite a government target of $5 billion in tourism revenue and 3 million arrivals for 2025, the first half of the year saw only $1.71 billion in earnings and 1.16 million arrivals, making the target highly ambitious.

Five Key Recommendations:

- Find the ways to accept “Mir” Cards and Russian Friendly Financial Transaction Modes: A crucial step is to enable Russian “Mir” card transactions within Sri Lanka. This measure is specifically aimed at keeping tourist spending within Sri Lanka and reducing reliance on informal fund transfers, which must be instrumental reduce the financial leakage of Russian inbound tourism in Sri Lanka.

- Regulate Against Illegal Guiding: It is recommended to curb illegal guiding by unregistered Russian expats in key tourist areas. This helps prevent tourist spending from being diverted to unregulated, informal services,

thus reducing service leakage. This will help to ensure more tourist spending stays within the formal economy and enhance the overall experience, thereby retaining and potentially increasing spendings

thus reducing service leakage. This will help to ensure more tourist spending stays within the formal economy and enhance the overall experience, thereby retaining and potentially increasing spendings - Improve Language and Service Standards: Offering Russian-language menus, signage, and services, along with increasing Russian language training for tourism staff and improving overall service standards across the sector, can enhance the tourist experience and encourage engagement with formal establishments.

- Improve Infrastructure and Attractions: Enhancing the accessibility through air and internal transport facilities, Wi-Fi availability, kids’ facilities, nightlife, theme parks, water parks, and casinos to suit Russian preferences that can keep tourists engaged and spending within the formal tourism offerings.

- Monitor and Strategize Pricing: Tracking Russian travel trends and dynamically adjusting policies such as flexible hotel pricing that can prevent issues like charter flight cancellations caused by rate hikes that seemed a lead to create a complete loss of potential revenue.

Selected References:

- https://russiaspivottoasia.com/russian-summer-2025-outbound-tourist-volumes-expected-to-increase-24-8/

- https://money-tourism.gr/en/potential-quot-comeback-quot-of-russians-in-europe-in-2025-these-are-the-must-visit-destinations/

- https://www.futuremarketinsights.com/reports/russia-outbound-tourism-market